BreakEvenPoint Onpulson Wirtschaftslexikon

How to Calculate the BreakEven Point for a Business

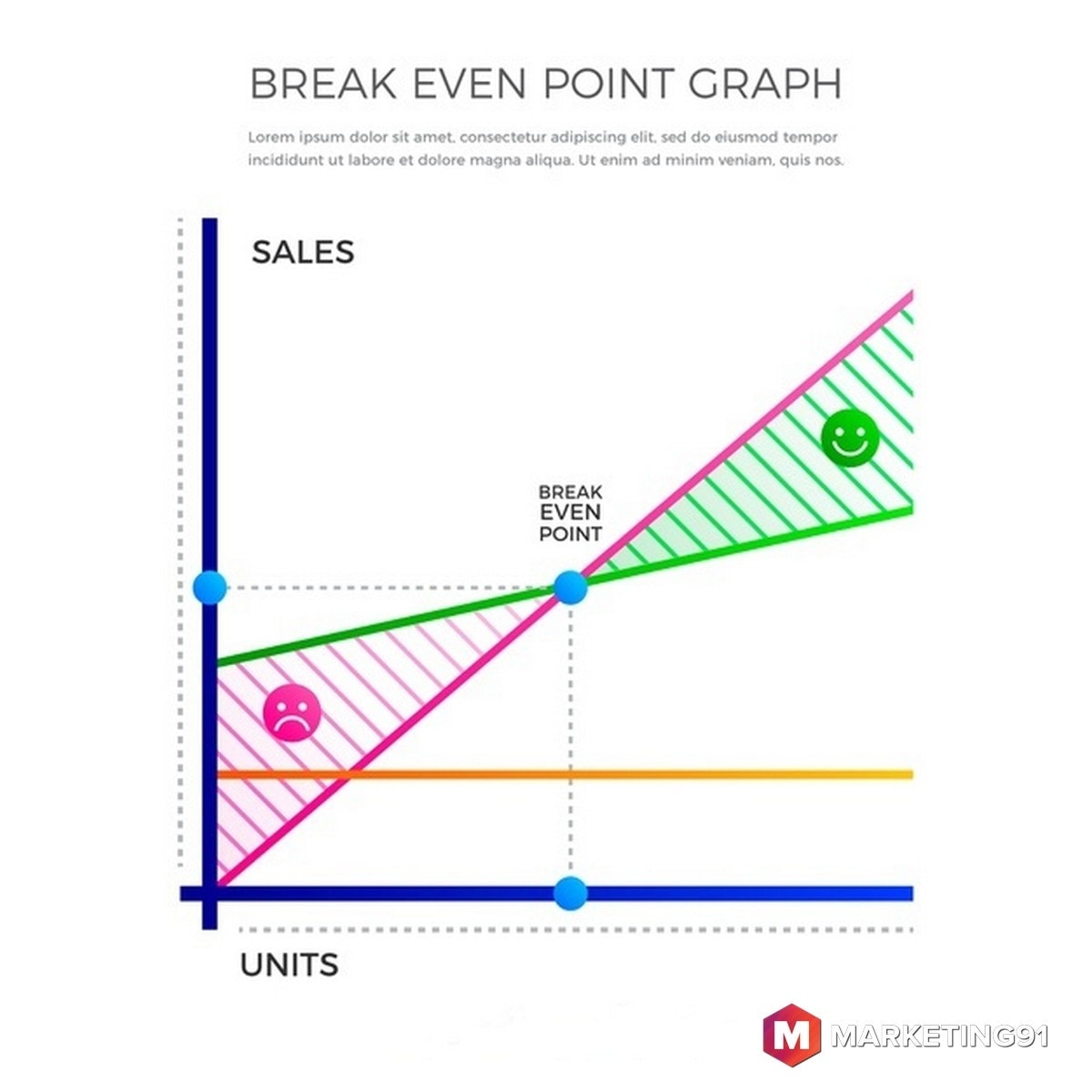

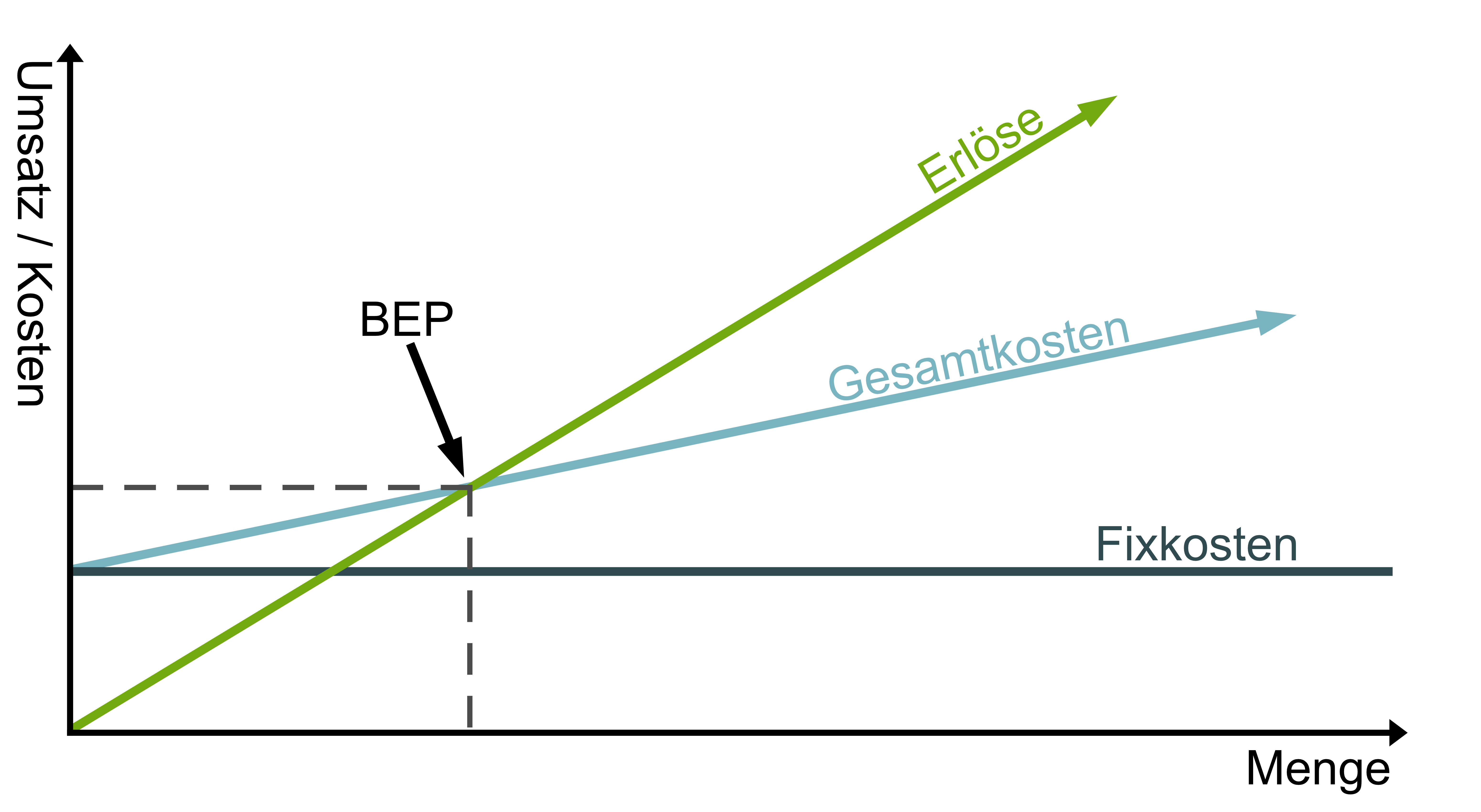

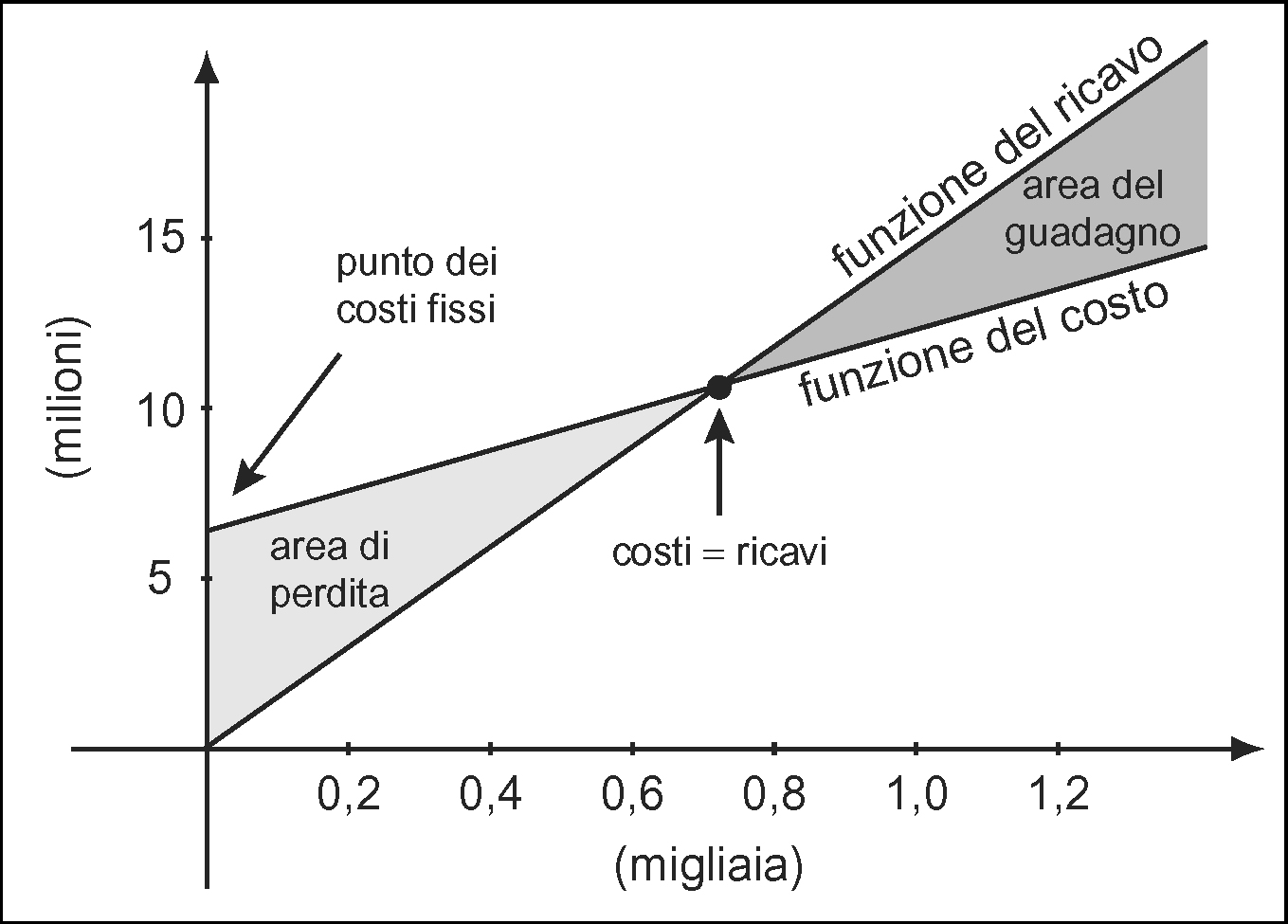

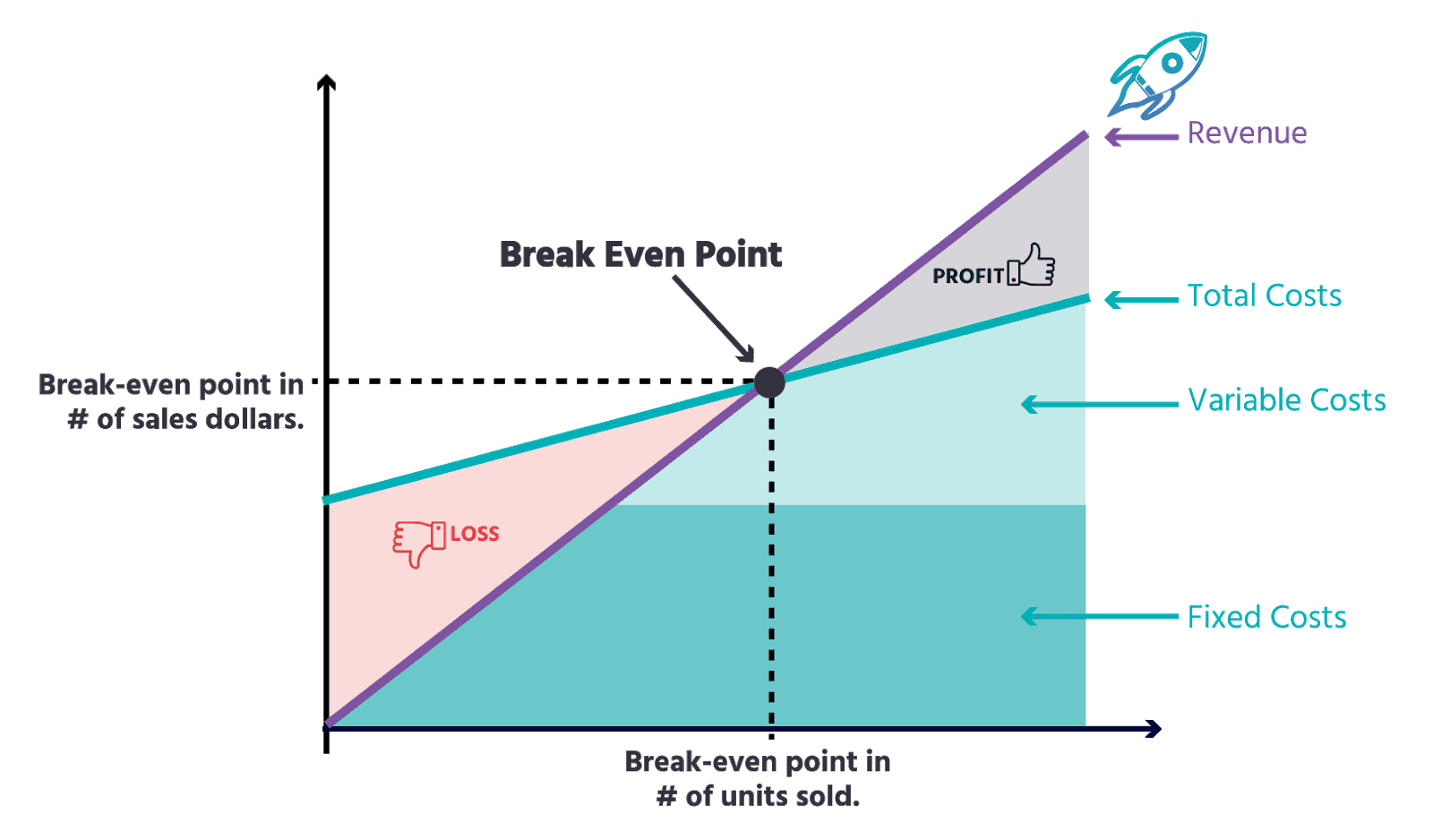

At the break-even point fixed sunk costs and marginal costs equal the marginal revenue. The yellow area gives the total loss for a number of units produced and sold which is less than the number of units needed to break even. The green area gives total profits accumulated after passing that critical point.;

Breakeven Point Meaning, Advantages, Disadvantages and Examples

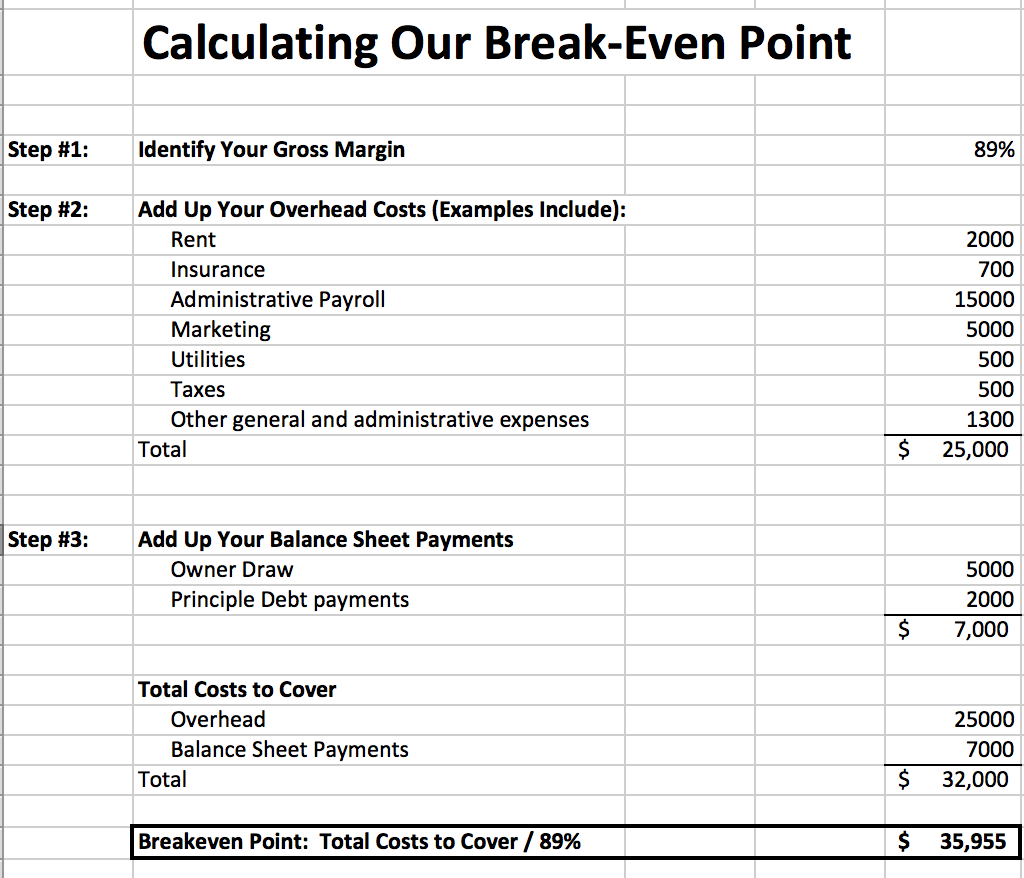

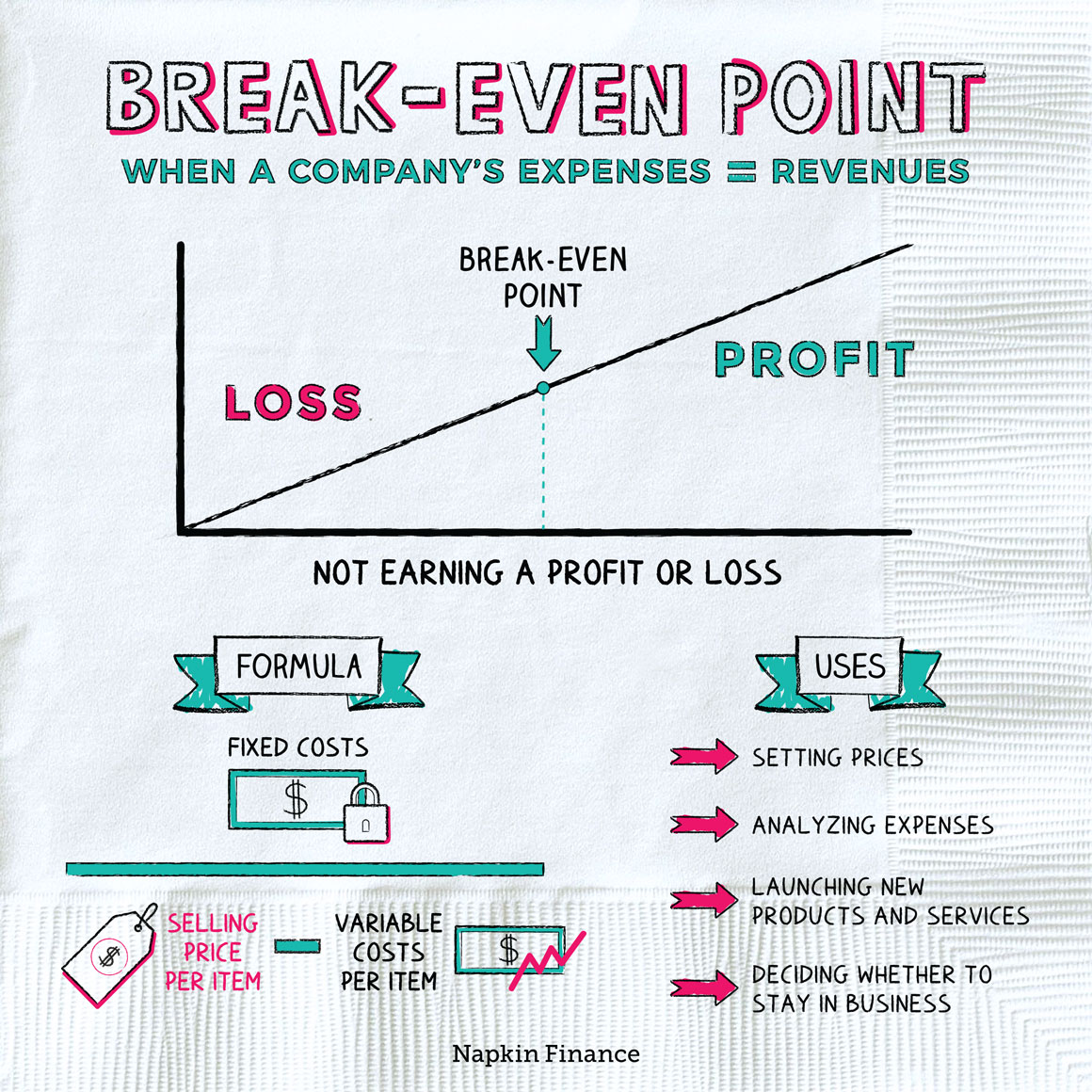

Break-even analysis is the effort of comparing income from sales to the fixed costs of doing business. The analysis seeks to identify how much in sales will be required to cover all fixed costs.

Break Even Point (BEP) Formula and Units Calculation

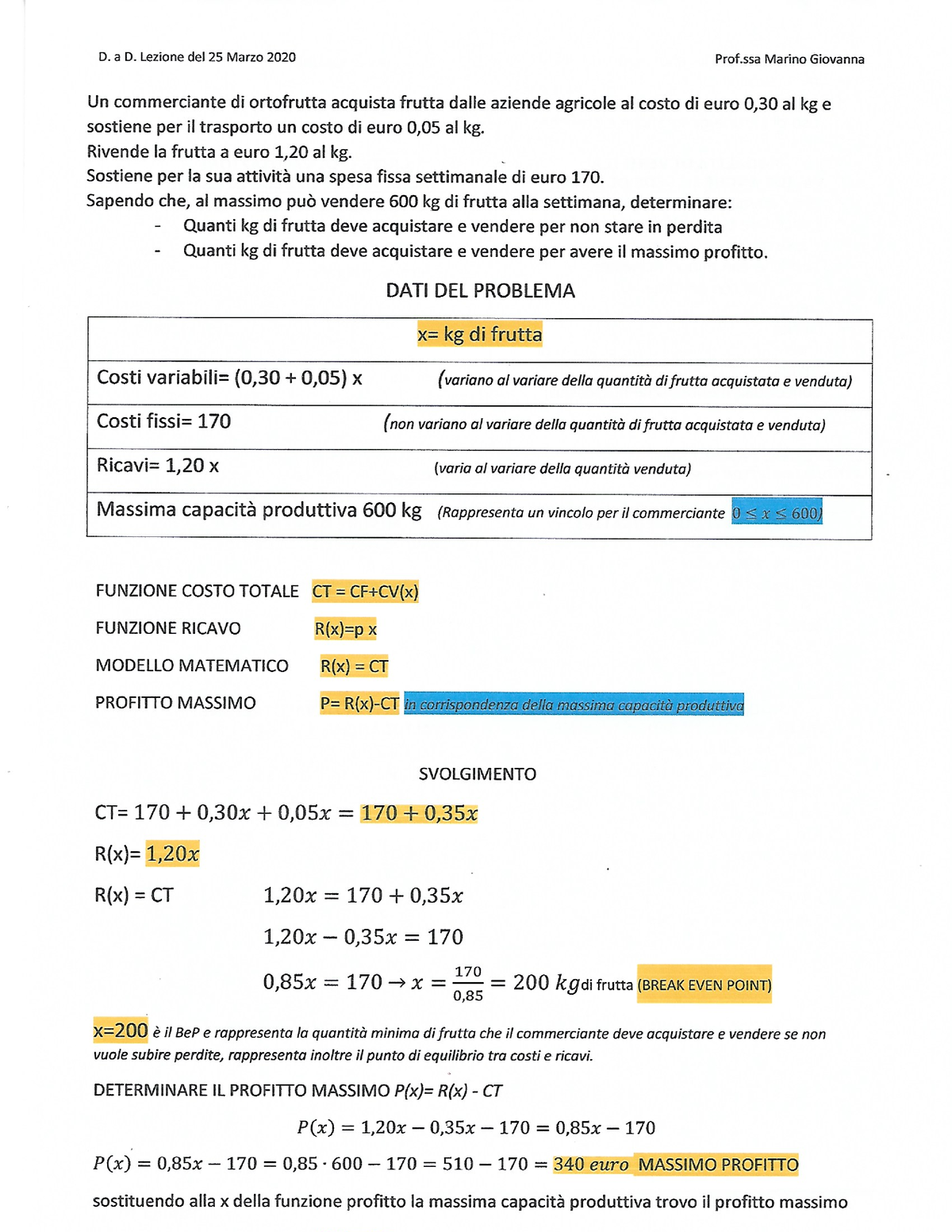

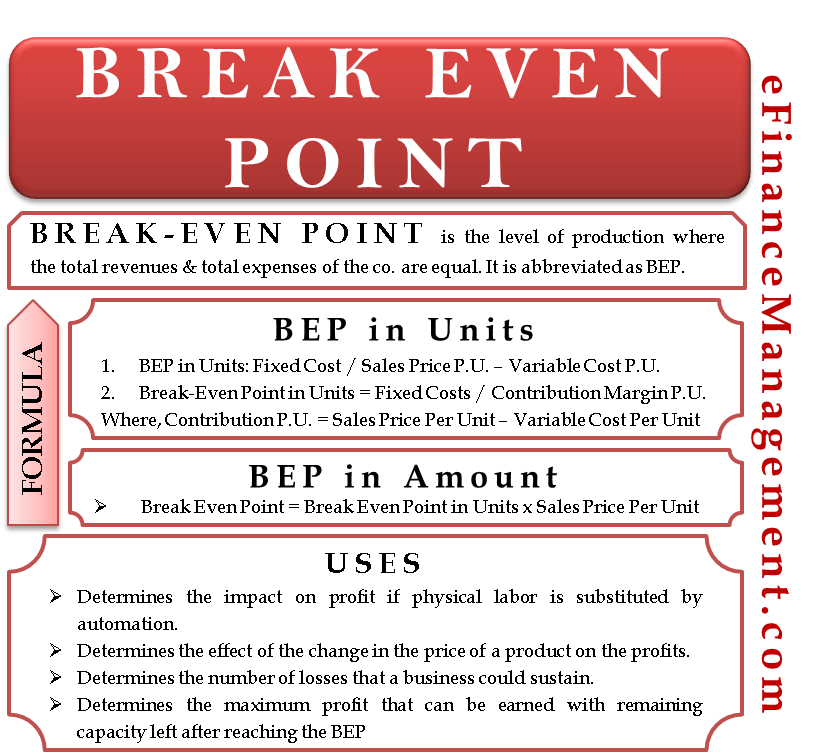

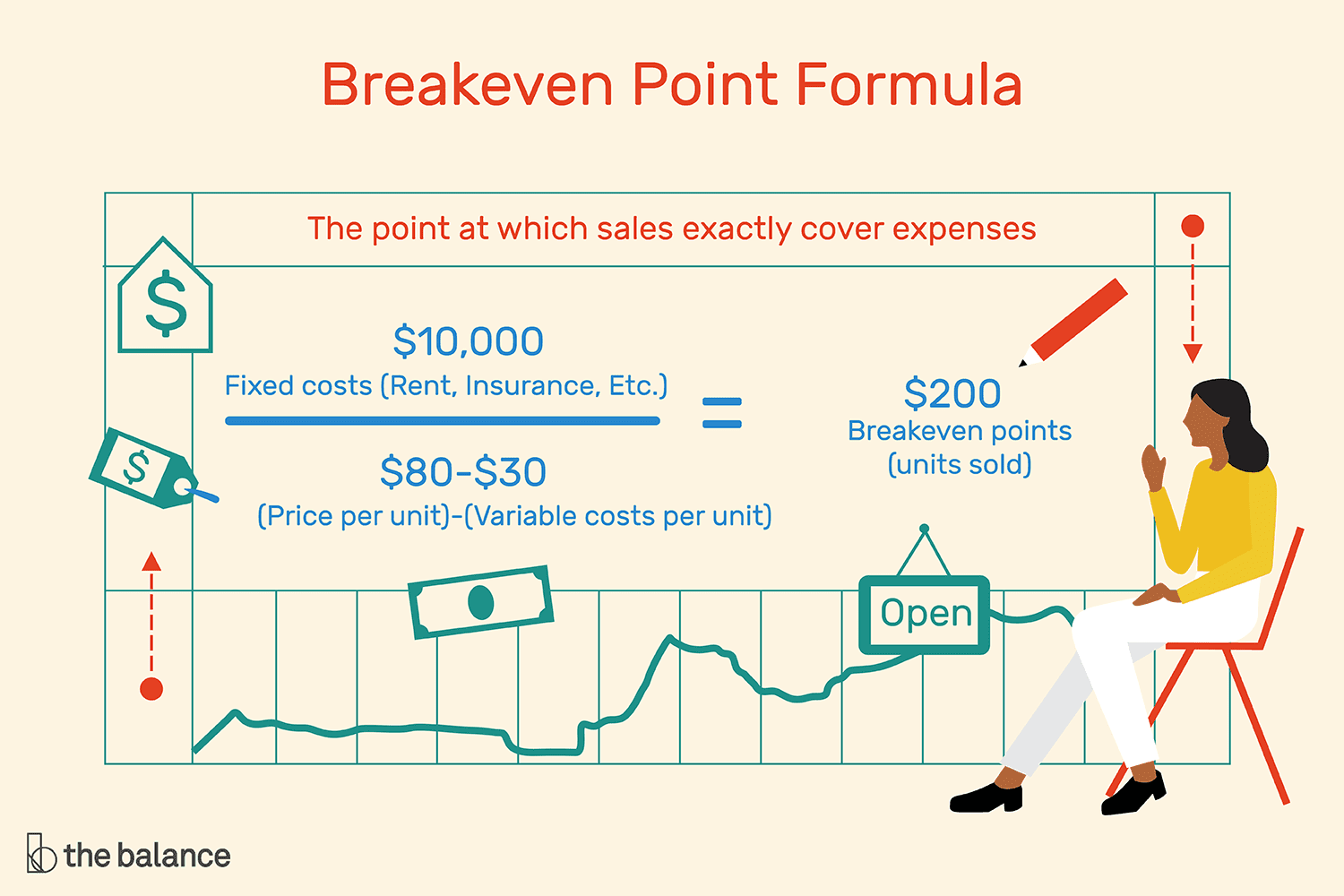

To calculate your company's breakeven point, use the following formula: Fixed Costs ÷ (Price - Variable Costs) = Breakeven Point in Units. In other words, the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Note that in this formula, fixed costs are stated as a total of all.

BreakEvenPoint Onpulson Wirtschaftslexikon

Still Going Strong on Calculus. When Mathematica 1.0 was released in 1988, it was a "wow" that, yes, now one could routinely do integrals symbolically by computer. And it wasn't long before we got to the point—first with indefinite integrals, and later with definite integrals—where what's now the Wolfram Language could do integrals better than any human.

Break Even Point (BEP) Formula + Calculator

The breakeven point ( breakeven price) for a trade or investment is determined by comparing the market price of an asset to the original cost; the breakeven point is reached when the two.

Break Even Point (Formula, Example) How to Calculate Break Even Point

Formula to Calculate Break-Even Point (BEP) The formula for break-even point Break-even Point Break-even analysis refers to the identifying of the point where the revenue of the company starts exceeding its total cost i.e., the point when the project or company under consideration will start generating the profits by the way of studying the relationship between the revenue of the company, its.

How to Calculate the BreakEven Point for Your Business Paychex

What is break-even point? In economy, the break even point is when you don't make a profit and you don't lose money either. In other words, your revenue or income is equal to your expenses. Say R = revenue and C = cost R = C Example #1: It costs a publishing company 50,000 dollars to make books.

Break Even Point Pengertian Manfaat Dan Cara Menghitungnya Magnate

The break-even point, or break-even quantity, is the number of units a company needs to sell in order to earn $0 and lose $0. The definition of the break-even point is that it is the quantity of.

break even point Archivi MarketingeImpresa

1 I just uploaded a sample Excel spreadsheet that mirrors the one I actually use. Based off of that photo of the sample spreadsheet, what would my break even point be? Aside from shipping costs, I have no other expenses at all. The blank spaces represent products that have not sold yet.

Break EVEN Point Matematica Finanziaria Studocu

Income Statement. Retained Earnings Formula. Gross Profit Margin Formula. To calculate the break-even point in units use the formula: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit - Variable costs per unit) or in sales dollars using the formula: Break-Even point (sales dollars) = Fixed Costs ÷ Contribution Margin.

break even point in "Enciclopedia della Matematica"

A break-even point analysis is used to determine the number of units or dollars of revenue needed to cover total costs ( fixed and variable costs ). Key Highlights Break-even analysis refers to the point at which total costs and total revenue are equal.

Free Vector Break even point graph

If breakeven point model represents zero profit scenario, is it possible as an entrepreneur to set the right level of production so as to realize a specific profitability level. This question can be answered by using an example; Example. FTZ co. ltd is a producer of medicinal juice for Covid-19 supplement purposes. The cost per unit data for.

Break Even Point Definition, Formula, Example, Uses, etc.

Break-Even Point Definition. In accounting, economics, and business, the break-even point is the point at which cost equals revenue (indicating that there is neither profit nor loss). At this point in time, all expenses have been accounted for, so the product, investment, or business begins to generate profit. The concept of "breaking even.

How to calculate Break Even Point (BEP)? Project Management Small

A Quick Guide to Breakeven Analysis by Amy Gallo July 02, 2014 In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You've.

How to Calculate My Business' Break Even Point Trailhead Accounting

Alternatively, the break-even point can also be calculated by dividing the fixed costs by the contribution margin. The total fixed costs are $50k, and the contribution margin ($) is the difference between the selling price per unit and the variable cost per unit. So, after deducting $10.00 from $20.00, the contribution margin comes out to $10.00.

How To Use A Break Even Point Calculator For Business Profitability

Why It Matters; 3.1 Explain Contribution Margin and Calculate Contribution Margin per Unit, Contribution Margin Ratio, and Total Contribution Margin; 3.2 Calculate a Break-Even Point in Units and Dollars; 3.3 Perform Break-Even Sensitivity Analysis for a Single Product Under Changing Business Situations; 3.4 Perform Break-Even Sensitivity Analysis for a Multi-Product Environment Under Changing.